t mobile taxes and fees calculator

For instance line 1 has a Federal Universal Service Charge of 098 while line 2 with the extra 15 intl option has a FUSC of 575. The below portion is just the taxes and fees above this section was the plan for 100 and 35 for each line and two installments 290.

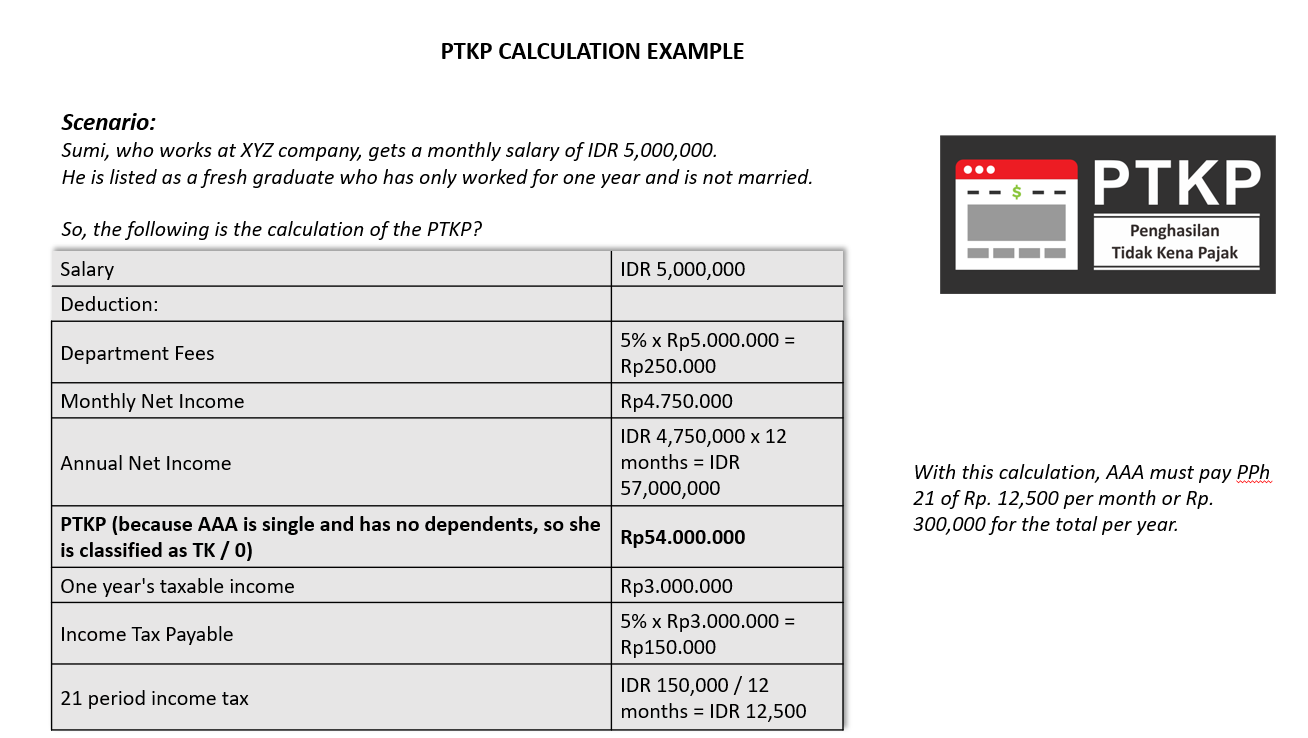

Indonesia Payroll And Tax Guide

Wireless tax rates by state.

. TMobiles fees are roughly 5 for 2. 7 lines not available MONTHLY COST 60 with 5 AutoPay discount Taxes and fees additional. Costs and Reviews in 2022.

Taxes cant really tell you but they fluctuate depending on the government. Unlimited high-speed data US. We charge you the State Cost Recovery Charge as a percentage-based fee to cover some of these costs.

You save per year Estimated savings based on your input with AutoPay. 35 or maximum allowed by law. This tax is collected so anyone can dial the number 911 in case of emergencies.

Enter your Service Address. Please enter a number. Again these are determined on the state level and have different tax rates.

If you want to change your mobile number T-Mobile makes it very easy but they will charge you a hidden fee of 15 every time you change your number. The federal tax rate on wireless service called the USF or Universal Service Fund is 664. Please enter a number.

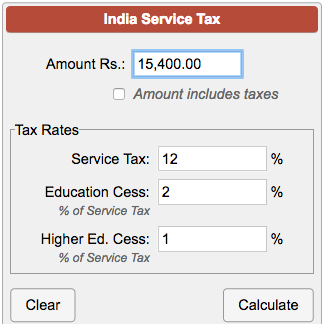

This isnt a tax that the state requires us to collect. Iklan Tengah Artikel 1. According to the consumer tax and spending think tank Tax Foundation average cell phone service fees and taxes have reached 186.

Most wireless 911 fees are levied at uniform rates statewide although there are a few exceptions. Magenta 55 at 70mo taxes and fees included for 2 lines on autopay and the. Total costs are based on the accounting.

BS fees shouldnt exist but when different governments create taxes that are wildly different it doesnt make sense for T-Mobile to eat them. Level 1 8m. T-Mobile Senior Plan.

Mobile number change fee. T mobile taxes and fees calculator Sunday February 27 2022 Edit. You can add the federal tax rate of 664 to the tax rate of your state to find out what percentage you are paying in taxes.

For Metro by T-Mobile the price for the Unlimited High-Speed plan assumes a 10 per line SIM fee charge and a waived Assisted Support Charge fee of 30 per line assuming the customer. Newer Post Older Post Home. 51 rows Below is a list of state local taxes and fees on monthly cell phone service.

Income Tax Calculator India Calculate Your Taxes For Fy 2021 22 Income Tax Calculator India Calculate Your Taxes For Fy 2021 22 Share this post. Chat to switch Chat to switch. T-MOBILE ESSENTIALS taxes and fees additional INDIVIDUAL FAMILY 2 lines minimum ADD-A-LINE 36 lines.

That might seem like a good deal. It does not include taxes and fees in the monthly price. With the Essentials Magenta 55 Plus plan with Autopay its about.

The T-Mobile Connect plan is the most affordable option around. Is there some kind of sliding scale. Enter your current monthy phone charges.

If you are required to return a device to T-Mobile you have to mail that device within. This estimate may differ from what appears on your bill because some taxes and surcharges apply to only a portion of your monthly charges depending on your plan features and device. This number also represents a 45 increase in these extra fees over the past decade.

We collect E911 taxes. However unlike the T-Mobile One plans taxes and. This isnt a government tax rather a fee collected and retained to help recover certain costs weve already incurred.

For 2 lines on autopay. If your payment does not go through for any reason. It includes an unlimited hotspot at 3G speeds.

T-Mobile does not have a Grace Period for late payments so if you are a day latea fee will show up on your bill. Surcharge amounts and what they pay for may change. Its partly why I think the taxes-and-fees-included move wasnt a great one for T-Mobile.

If youre 55 or older and youre looking for an affordable cellular plan then T-Mobile has some of the best options available. This means that wireless customers are paying an average of 225 per year above and beyond the actual price of their mobile service. The Phone Administrative Fee is a per-line per-month fee.

This will appear on your bill as One time charge for MSICHG. We pay certain taxes to state governments give you service. Essentials 55 at 55mo plus taxes fees.

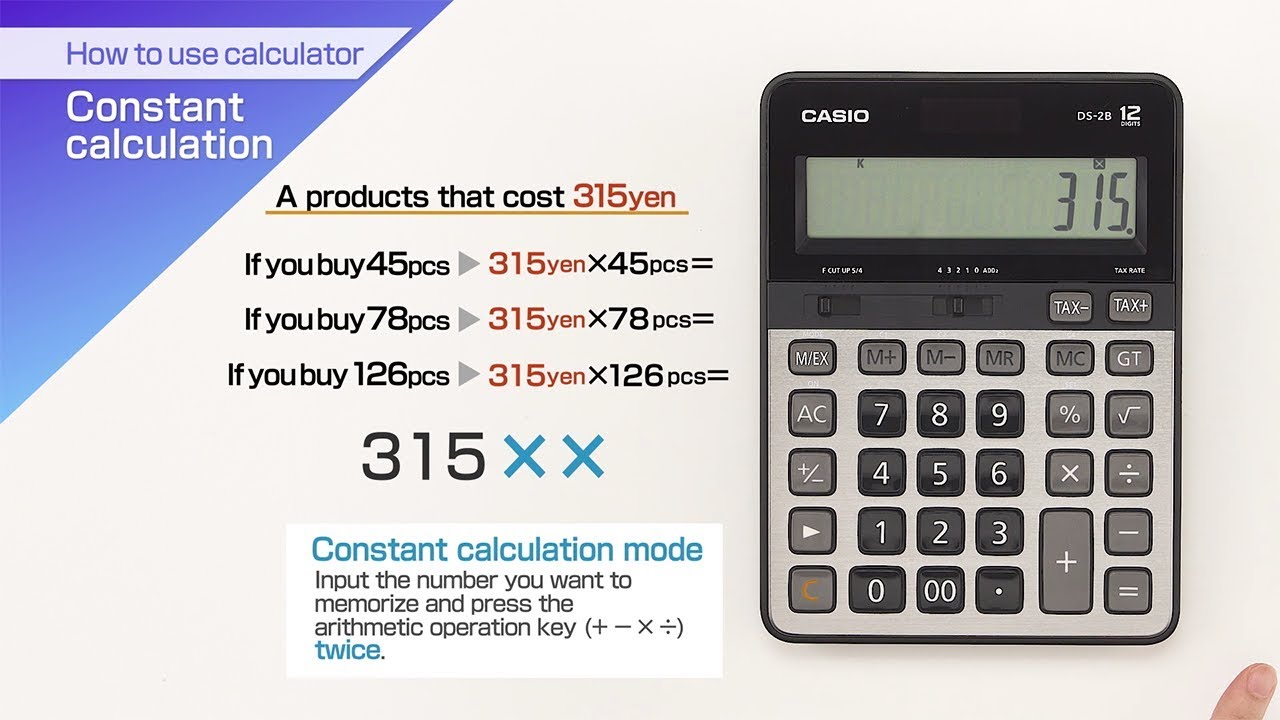

ATT Phone Administrative Fee. It varies depending on the amount owed and your delinquency - at a minimum it will be 5. This calculator will help you compare the total cost of plans with different price structures over the next two years.

Federal Universal Service Fund. In 2018 the state of Illinois increased the 911 fee from 87 cents per line per month to 150 per line per month except in the city of Chicago where the fee was increased from 390 per line to 500 per line per month. 313 rows Since 2008 average monthly wireless service bills per subscriber have dropped by 26 percent from 50 per line to about 37 per line.

The new T-Mobile Essentials plan offers a just the basics service for 60 per month. In CanadaMexico up to 5GB high-speed data then unlimited at up to 128kbps. Line 1 state sales tax is 070 while line 2 is 205.

State and Local Tax. Click or tap to enter an amount. At the end of 2019 over 67 percent of low-income adults had wireless as their phone service and 58.

However wireless taxes have increased by 50 percent from 151 percent to 226 percent of the average bill. Taxes and fees may also change from time to time without notice. The best is that you will get is an estimate depending on E911 and local and county taxes plus your.

Its just 55 per month for two lines with Autopay plus taxes and fees just 40 for a single line and includes everything that comes with T. Similarly state and city sales taxes do not appear to be purely percentage-based either.

Pin By Clenoro On Tax Pajak Google Play Tanda

How To Calculate Cannabis Taxes At Your Dispensary

Illustration Of A Hand Holding A Calculator Free Image By Rawpixel Com Waraporn Free Illustrations Vector Free Illustration

3 Tax Mistakes Notaries Should Avoid Notary Notary Public Business Notary Signing Agent

Self Employed Tax Calculator Business Tax Self Employment Success Business

Accountant Cpa Office Professional Taxes Calculator Let S Get Fiscal Cookie Crush Cookie Decorating Sugar Cookie

Casio Scientific Calculator With Natural Textbook Display In 2022 Scientific Calculator Casio Scientific Calculators

How To Calculate Sales Tax In Excel

Modern Professional Accountant Tax Calculator Business Card Zazzle Com Zazzle Business Cards Mini Business Card Photo Business Cards

Catch Up On Bookkeeping Exceptional Tax Services Bookkeeping Business Money Small Business Tips

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

How To Calculate Import Customs Duty And Taxes In Pakistan Custom Export Business Imports

Pemerintah Bakal Revisi Pp Tax Holiday Dan Tax Allowance Keuangan Pemerintah Pengusaha

Mortgage Calculator With Taxes And Insurance Mortgage Calculator Mortgage Free Mortgage Calculator

Tax Calculation Flow Chart Download Scientific Diagram

Calculator Math With Taxes And Coin Vector Illustration Design Affiliate Taxes Math Calculator C Vector Illustration Design Cover Template Drawing S